best strategy for trading forex: 3 Easy and Simple Forex Trading Strategies For Beginners

Contents:

The 38% retracement level of Fibonacci level is used in Elliot wave theory when a price break and it is subsequently sustained below the 38.2% level for a period longer than 15-minutes. On the second day, when the high or the low of the first 15-minute candle breaks, traders will trade in that direction. Although considered an intraday strategy, this strategy is performed over two days.

Tweaking is always necessary as no one has a true “holy grail” trading strategy. There is no one-size-fits-all answer to this question – as it depends on a number of factors. For example, this includes the types of pairs you are trading, how much you are staking, what percentage gains you make, and how much leverage you apply.

# Tip 3 – Learn the Art of Trading without Emotion

Even a small-https://g-markets.net/ advantage is huge in forex trading, but don’t be too trusting. Most signal sellers are scammers and just want to get your money and disappear with it—be very skeptical when it comes to these things. If you go online and look at forex brokerage reviews and the comments people put up, you’ll probably come to the conclusion that every single broker will steal your money.

Forex Trading Long-Term Strategies (Pros, Cons and More … – Benzinga

Forex Trading Long-Term Strategies (Pros, Cons and More ….

Posted: Fri, 23 Sep 2022 07:00:00 GMT [source]

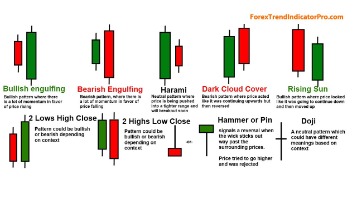

The above chart shows range opportunities that occurred in the Daily candle chart of USDJPY over 24 days. The downward trend line dates from 2018 so is a significant technical indicator. The weekly price chart shows GBPUSD posting a series of green / bullish candles during the last three weeks and price action looks bullish. Strong part of trend following purposes that are good to trade in market. It give good trend trading system lines that give best detection trend on market to show best results to its viewers that how this indicator share amazing stuff for traders to trade.

Forex Volume Trading Strategy

Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. The Germany 30 chart above depicts an approximate two year head and shoulders pattern, which aligns with a probable fall below the neckline subsequent to the right-hand shoulder. In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. Towards the end of 2018, Germany went through a technical recession along with the US/China trade war hurting the automotive industry. Brexit negotiations did not help matters as the possibility of the UK leaving the EU would most likely negatively impact the German economy as well.

You must remain calm and collected irrespective of your trading results. Overlapping Fibonacci Trade – Though not as reliable as other strategies, traders can use it to their advantage by combining it with appropriate signals. The spread is simply the difference between the buy and sell price of a forex pair.

Numerous traders are utilizing an old and non-productive methodology to purchase and sell rates. Strategies that use specific trade entries and use reliable risk management methods will help you on your way to having an excellent personal finance plan. The level of risk that you will be using should be comfortable for you, and we recommend contacting a financial advisor to help you with your situation. If you are in that category, you will have to find the best long-term trading strategy that you can and then trade that in the mornings before work or in the evenings after work. We also recommend viewing our Traits of Successful Traders guide to discover the secrets of successful forex traders. Successful trading requires sound risk management and self-discipline.

Are these trading strategies easy enough for beginners to use?

The Williams %R indicator was developed by famed trader Larry Williams. The indicator represents the level of the closing price relative to the highest high for a user-specified number of bars or periods. It is another momentum indicator that shows where the price is relative to the high and low range of a set number of bars or periods.

To open an account, you will need $10 however to use SmartPortfolios, a minimum deposit of $2000 is required. Research tools are also available such as economic calendars and Twitter. Laura is a freelance content writer focused on financial and legal technology, decentralized finance, cryptocurrency and related topics.

Scalpers open and close multiple positions each day either manually or with a trading algorithm that uses your guidelines to know when to buy/sell. This is a long-term strategy that requires fundamental analysis but also following macroeconomic trends and relevant news. The idea is to pinpoint the so-called “head and shoulders” price points over a long period and use them to learn whether prices are going to move up or down in the foreseeable future. Unlike range trading, this strategy uses price trends to find buying and selling opportunities. Here you must also find the lowest lows in the price chart and the highest highs.

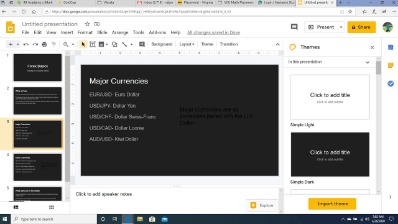

The liquid major pair in the forex market is EUR/USD – which will see you trade the exchange rate between the euro and US dollar. All of the aforementioned pairs have a number of core characteristics that are highly suited for newbie traders. The platform makes the research profile simple, as you can search for a trader based on your preferred metrics.

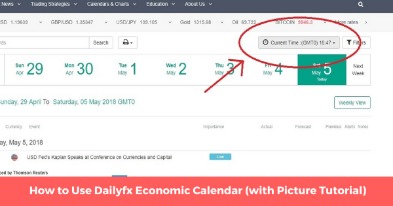

To do this we will be using the technical analysis charts and indicators provided by top-rated broker eToro. We are now going to show you how to can start day trading forex from the comfort of your home with the best currency broker and the best day trading platform of 2021 – eToro. In the sections below, you will find a selection of the best forex day trading platforms for beginners.

Often, traders who trade the news use scalping strategies while they wait for news to create something a little more exciting and worth the effort of trading. Ten steps can be used by traders to assist them in formulating an effective trading strategy. We provide Quality education related forex and indicators tool for your mt4.My all indicators system and robot Give you good trend in daily or weekly charts. This blend is additionally used to distinguish the intermingling and the difference in the market pattern. Just, both of these indicators are utilized for likely breakouts indicator in the Forex market.

This forex trend indicator shows the average price of the market and provides a quick representation of its historical price movement. It can also help to identify when the market is not trending but instead in a range . Forex trend indicators enable traders to analyse the trend of the market. While technical analysts will focus on analysing cycles to determine the trend, some of the best forex indicators for trending markets can give you the information you need much more quickly. The advantages of day trading Forex is that you will not be marked as pattern day trader. Also, the markets are a lot more volatile in Forex so you can capture a big move in a short period of time.

Understanding price action is one of the safest tips in the world of trading Forex. This step refers to the analysis and interpretation of the latest currency exchange rates. These figures can be displayed in a variety of forms, such as candlestick charts or lines.

The firm’s computer algorithms were identifying the medium and long-best strategy for trading forex trends and riding them down and then back up again. Whether you are a complete beginner, or an experienced trader looking to find the best forex strategy, do remember that the lessons can be as easily learnt trading virtual funds on a Demo account. Scaling up the risk will help you realise the importance of developing a trading psychology. The best forex traders are adept at managing the emotions of trading and using a Demo account before trading for real can break the learning process down into a two-stage process. When determining your trading strategy, you will also have to consider how much money you will have to start with. The amount of money in your trading account can make a big difference as to what type of strategy would be best for you.

Forex.com Trading Accounts and Products

This could be price consolidation before breaking through the resistance level. For scalpers, the longer-term price move is of less interest than the short-term trading opportunities offered by buying in the lower zone and selling in the higher one. Closing out those trades and putting them back on in reverse would have generated profits for more than three hours. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

- The essence of the carry trade is to profit from the difference in yield between two currencies.

- This top forex broker’s CFD account charges no commissions and offers good leverage, making it an excellent option for forex traders of all experience levels.

- There are some things that you need to be aware of to trade it correctly.

- If the Yen appreciated enough against the Canadian dollar, the trader would end up losing money.

Scalpers benefit from advanced charting, as well as speedy execution thanks to the trading platform’s ECN-style execution system. With advanced technical analysis tools, tight spreads and a wide range of tradable assets, OANDA is an excellent forex broker for both experienced and beginner forex traders. Yes, you can earn a living buying and selling using online trading platforms. The most important thing to remember is that you need to find a strategy that fits your specific trading style.

If the account you hold your long position in pays interest on credit balances, there is, of course, an opportunity to earn a second passive income from that part of the strategy as well. It could even be the case that markets are quiet, for example, during the summer months when a lot of institutional investors are on holiday. That is achieved by opening and closing multiple positions throughout the day. They can be directional, all buys or all sells, but are more likely to be a mix of both.

The strictest definition of Day Trading is that all positions are closed out at the end of the trading day — there is no over-night risk. This feature of the strategy developed out of day trading activity in the stock markets. Stocks and shares on exchanges such as the Nasdaq are typically on something near a 9–5 basis. Price moves between the previous day’s close and next day’s opening price can be significant and are out of an investor’s control. With so many of the strategies being well known within the market, there are trading opportunities to be had by trading the crowd. Scalping forex strategies, for example, can become crowded and with a lot of traders placing stop-losses near the same level these can be triggered, causing a momentary spike in prices.